Source: Zerohedge | VIEW ORIGINAL POST ==>

Having been left for dead by almost everyone, and missing out on much of 2024’s surge in bitcoin, the second largest crypto currency Ethereum has finally staged a powerful rebound in recent weeks, with the derivatives market signaling further bullish momentum as futures open interest surged over 12% to an all-time high of $20.8 billion on Friday. This followed a 7% price increase over the past 24 hours that pushed Ethereum to $3,365.

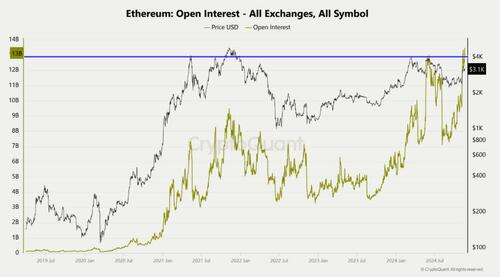

Open interest, which measures the total number of outstanding contracts in a derivatives market, has reached unprecedented levels for Ethereum. Analysts cited by The Block attribute this surge to heightened bullish sentiment among derivatives traders.

According to a CryptoQuant report, the Ethereum OI-weighted futures funding rate has spiked numerous times over the past week to hit new all-time positive highs, signaling a prevailing dominance of long-position traders. It is currently at 0.0374%, according to Coinglass data. “This suggests a market sentiment favoring upward price movements in the short term,” the CryptoQuant report added.

What is notable is that even as the price of ether languished and went nowhere as so many of its crypto peers exploded higher in recent months, the Ethereum futures market had seen substantial growth. According to CryptoQuant data, Ethereum’s open interest has grown over 40% in the last four months, crossing the $20 billion mark and surpassing its previous high of over $17 billion in May.

“Ethereum’s derivatives market activity reflects growing investor engagement, with futures open interest recently crossing $20 billion for the first time,” said a CryptoQuant analyst.

The result is that Eth futures funding rates are currently positive, signaling a market skewed toward long positions. Additionally, Ethereum’s estimated leverage ratio—a measure of the open interest divided by exchange reserves—has climbed to a new record of 0.40. This suggests increased risk-taking among traders, as they use higher leverage to amplify potential returns.

However, the CryptoQuant report warned that elevated leverage and the dominance of long positions could increase the risk of a long squeeze. “Sudden price volatility could trigger liquidations, leading to market corrections,” the CryptoQuant report added.

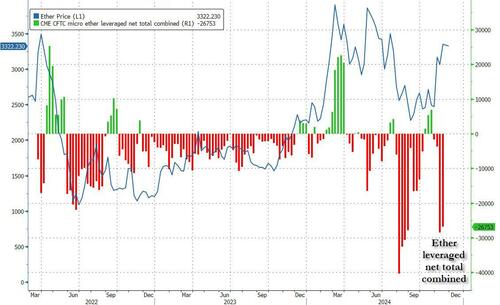

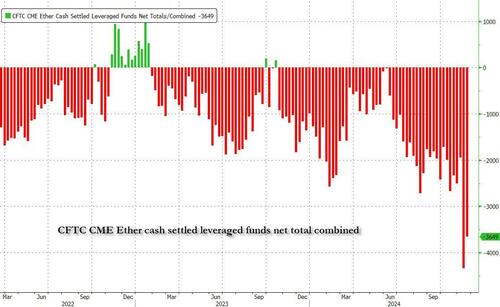

On the other hand, one can argue that a short squeeze is just as, if not more likely as a result of the massive build up of leveraged fund (i.e. hedge fund) shorts in both micro ETH….

… and especially in the large cash settled futs, which in the last two weeks saw the second biggest weekly increase on record.

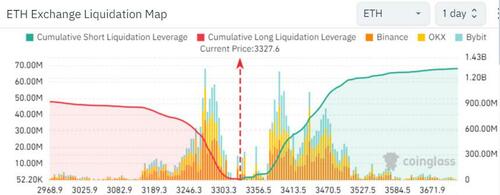

So should the price of ETH rise above 3,400 where the bulk of the short liquidation triggers are located…

… ETH may soon finds its way back to all time highs.

Loading…