Source: Zerohedge | VIEW ORIGINAL POST ==>

By John Kemp, energy analyst and founder of JKempEnergy

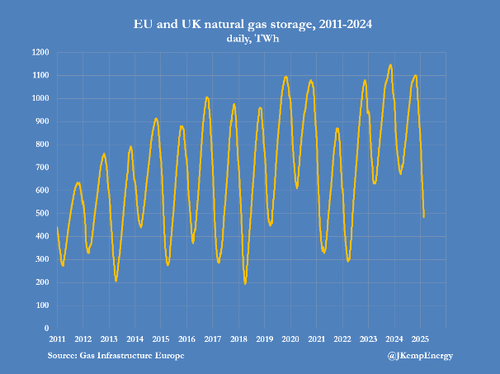

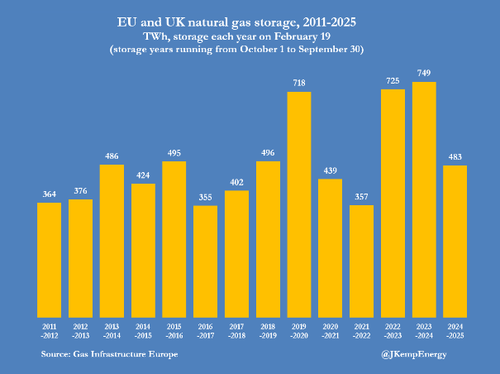

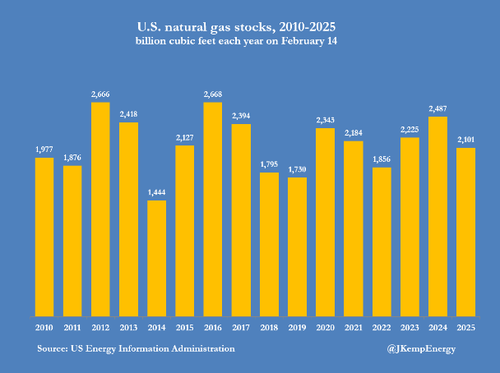

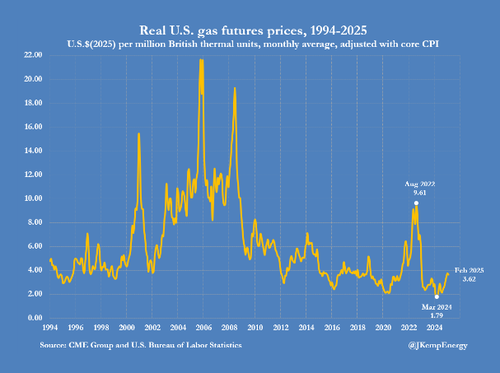

Spot market gas prices around the world have doubled over the last twelve months as reported inventories in all the major consuming regions have fallen to multi-year lows, signalling the refill season will be much tougher in 2025.

Sharply higher prices will encourage electricity generators to switch to alternative fuels and force energy-intensive industries in Europe and price-sensitive utilities in South and Southeast Asia to cut use wherever possible.

Combined inventories across the European Union, the United Kingdom, Ukraine and the United States are 400 terawatt-hours (1,446 billion cubic feet or 32 million tonnes of LNG) lower than they were a year ago:

- EU and UK inventories were 266 TWh (961 bcf or 21 million tonnes) below prior-year levels on February 19.[1]

- Ukraine’s inventories were 28 TWh (103 bcf or 2 million tonnes) below year-ago levels on the same date.[2]

- U.S. inventories were 106 TWh (386 bcf or 8 million tonnes) below prior-year levels on February 14.[3]

Japan’s inventories were also 6 TWh (22 bcf or 0.5 million tonnes) below prior-year levels at the end of October, the most recent data available, and have likely remained below year-ago levels since then.[4]

Since the second quarter of 2024, consumption has grown faster than production as a result of record gas-fired generation and lower drilling in the United States, a colder winter in North America and Northwest Europe, and sanctions on Russia.

As a result, surplus gas inventories carried over from a mild winter in North America and Northwest Europe in 2023/24 have been entirely used up over the course of winter 2024/25.

But the rapid emptying of storage has become unsustainable and prices have climbed steeply to rein in consumption and encourage more drilling to conserve the remaining stocks.

Front-month futures prices have doubled over the last year in North America and Northwest Europe and are up by 75% in Northeast Asia compared with the same point in 2024.

The biggest increases have come in near-dated futures contracts to conserve the remaining stocks as much as possible and curb consumption over the summer of 2025 to enable stocks to be rebuilt ahead of winter 2025/26.

With the United States, the European Union, Ukraine and Japan all needing to rebuild inventories faster-than-average over the summer of 2025 there will be fierce competition for gas over the eight months to October.

Energy-intensive industrial users in Europe and price-sensitive buyers in South and Southeast Asia are likely to be priced out, as they were during the first summer after Russia’s invasion of Ukraine in 2022.

In the event of a persistent summer heatwave over North America, Northwest Europe, Northeast or South and Southeast Asia driving higher-than-normal airconditioning loads, the scramble for gas could become intense.

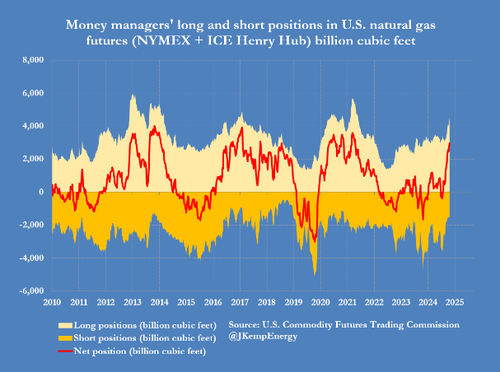

Anticipating tight supplies and a tough refill season, portfolio investors have alreadyamassed exceptionally large bullish positions in futures and options based on gas prices in both North America and Northwest Europe.

In North America, hedge funds and other money managers have accumulated a net long position equivalent to 2,975 billion cubic feet, the highest for more than three years and in the 91st percentile for all weeks since 2010.

In Northwest Europe, investment funds had amassed a near-record bullish net long position equivalent to 292 TWh by the first week of February, before selling 34 TWh to realise some profits in the second week of the month.

Fund buying has anticipated, accelerated and amplified market tightness and price rises this summer, enforcing an early adjustment by encouraging fuel switching in favour of coal and fuel oil and compelling more industrial closures.

Europe’s policymakers, facing another year of painfully high prices for households and industry, will be tempted to blame hedge funds and other speculators (as is always the case when prices escalate rapidly).

But the reality is that the global market will be much tighter this summer than it was in 2024 and 2023 and prices have to rise to restore balance by curbing consumption and encouraging a return to production growth in the United States.

[1] Aggregated Gas Storage Inventory (Gas Infrastructure Europe, February 21, 2025).

[2] Aggregated Gas Storage Inventory (Gas Infrastructure Europe, February 21, 2025).

[3] Weekly Natural Gas Storage Report (U.S. Energy Information Administration, February 20, 2025).

[4] Trend of Natural Gas and LNG Prices (Japan Organization for Metals and Energy Security, January 30, 2025).

Loading…